1. Own and operate a business in Australia for 2 years during the period of holding the 188 visa, with the turnover of the business reaching more than 300,000 Australian dollars one year before applying for permanent residence

2. Having lived in Australia for 1 year during the 2-year period of operating the business

3. In addition to the above requirements, 2 of the following 3 conditions must be met 1 year prior to application:

A) A$200,000 of company net assets;

B) A$600,000 of net personal AND company assets in total;

C) Employment of two full-time local employees.

*In addition, some states have specific requirements to be met.

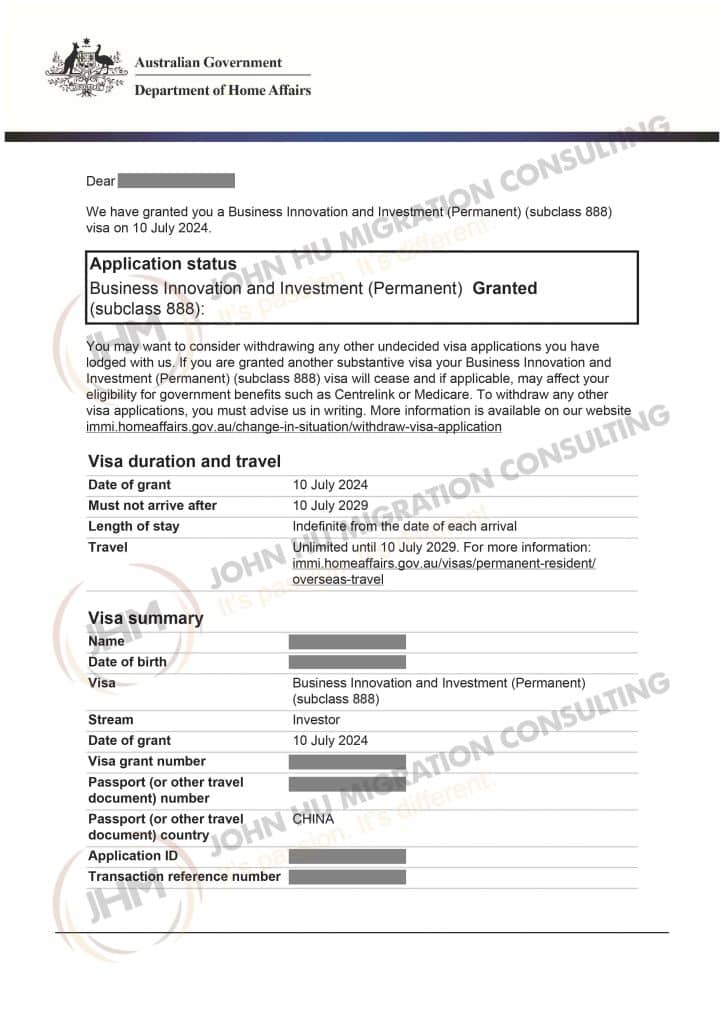

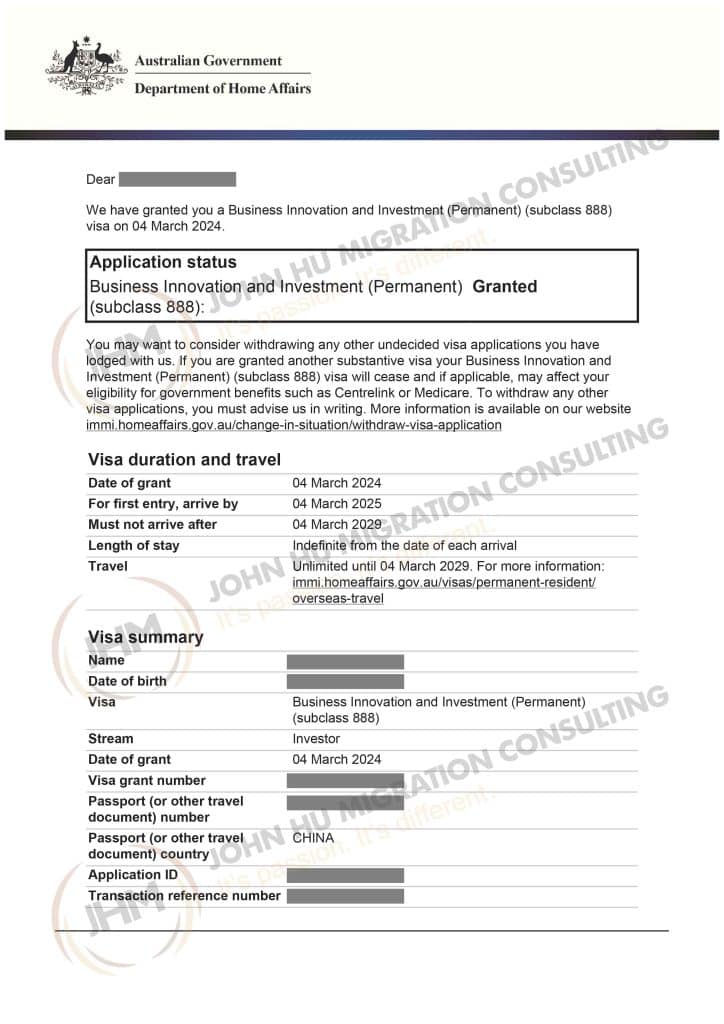

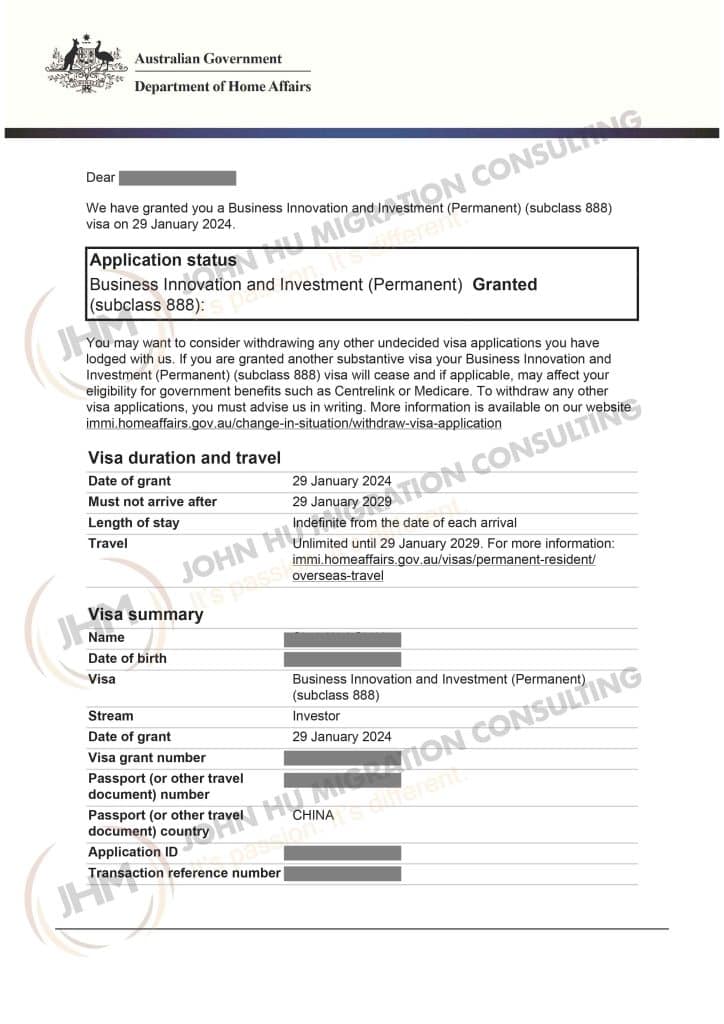

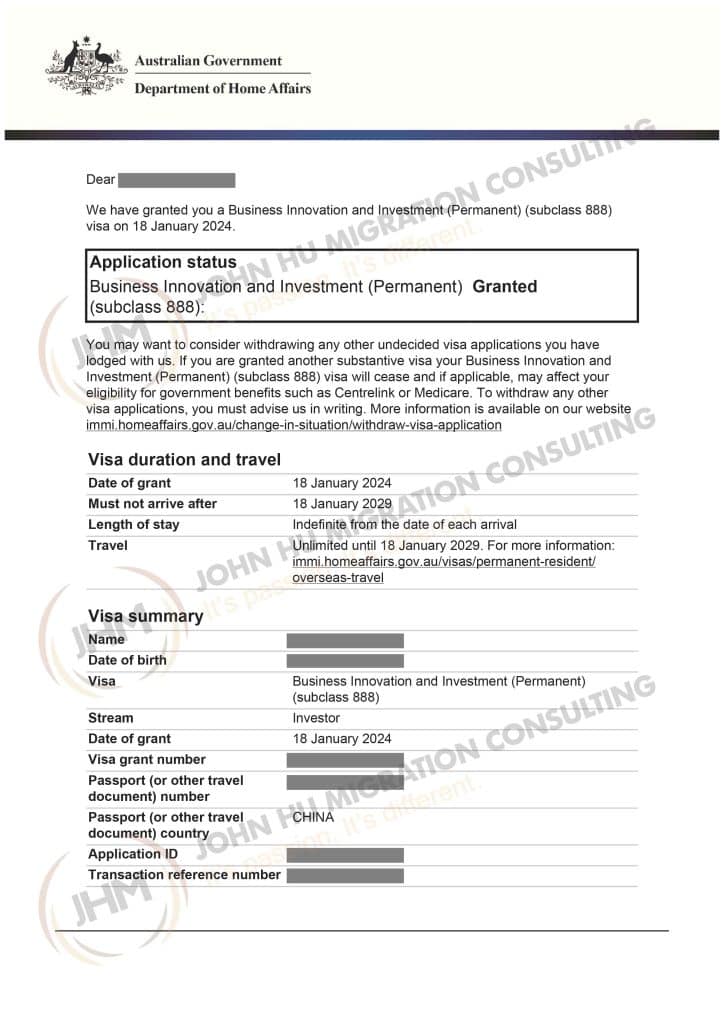

1. Holding the 188B visa for at least 3 years before applying for permanent residence.

2. In possession of A$2.5 million in complying investment during the 188B visa period (before getting 888B approval).

3. A cumulative total of 2 years of residence by the main applicant/spouse in the nominating state within the 3-year period prior to the permanent residence application

4. Investment Compliance Requirements.

(a) At least 20% of the capital, i.e. not less than A$0.5M in Venture Capital and Development Private Equity (VCPE) funds;

(b) At least 30% of the capital, i.e. not less than A$0.75M, in Emerging Business;

(c) At least 50% of capital, i.e. not less than A$1.25M in Balancing Investment

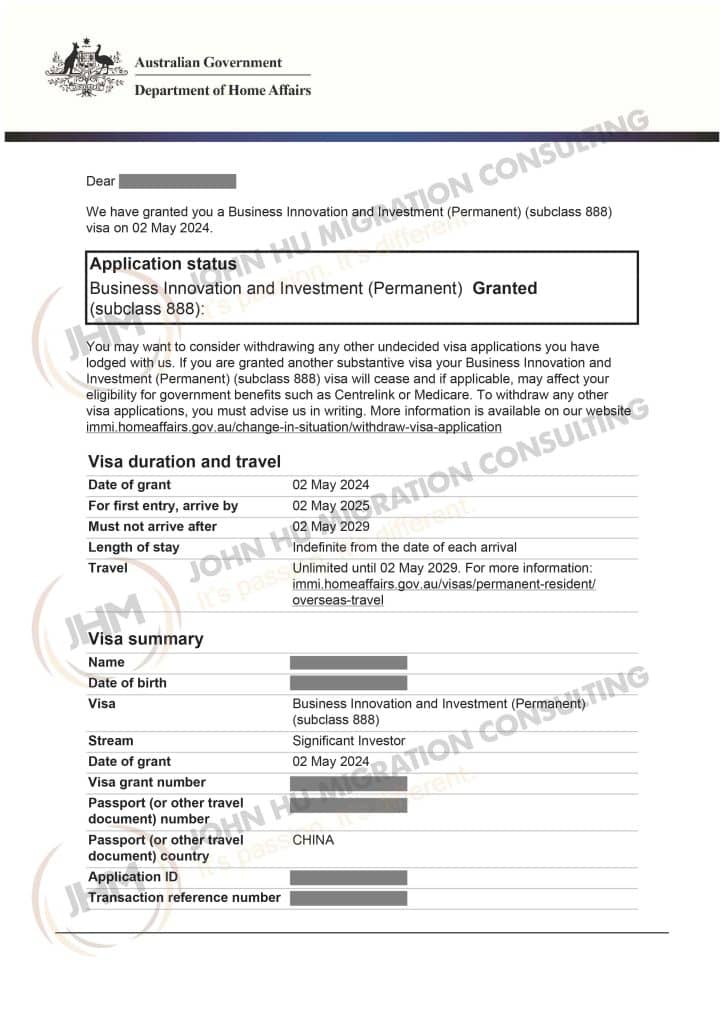

1. Holding the 188C visa for at least 3 years before applying for permanent residence

2. In possession of A$5 million in complying investment during the 188C visa period (before getting 888C approval).

3. Residential requirements: (choose one)

While holding a 188C visa,

(a) The 188C main applicant must reside in Australia for an average of 40 days per year (cumulative).

(b) The spouse of the 188C main applicant must reside in Australia for an average of 180 days per year (cumulative).

4. Investment Compliance Requirements.

(a) At least 20% of the capital, i.e. not less than A$1M in Venture Capital and Development Private Equity (VCPE) funds;

(b) At least 20% of the capital, i.e. not less than A$1M in Venture Capital and Development Private Equity (VCPE) funds;

(c) At least 20% of the capital, i.e. not less than A$1M in Venture Capital and Development Private Equity (VCPE) funds;